Loading

Get Form F47097 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form F47097 online

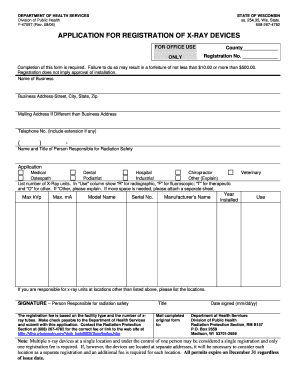

The Form F47097 is a crucial document for registering x-ray devices in Wisconsin. This guide provides a detailed, step-by-step process for successfully completing this form online, ensuring adherence to the required protocols.

Follow the steps to accurately complete the application for registration of x-ray devices.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Provide the name of the business in the designated field. Ensure that the name is exactly as it appears on official documents.

- Enter the business address, which includes the street, city, state, and zip code. Make sure all details are accurate and complete.

- If the mailing address differs from the business address, fill in the mailing address field appropriately. If both addresses are the same, you may leave this section blank.

- Input a telephone number in the provided space, including any necessary extensions.

- Identify the name and title of the person responsible for radiation safety. Ensure that this individual is knowledgeable about x-ray regulations.

- Select the type of application by marking the relevant option, such as medical, dental, hospital, chiropractor, veterinary, osteopath, podiatrist, industrial, or other. If selecting 'other,' provide a brief explanation.

- List the number of x-ray units and indicate their use by entering ‘R’ for radiographic, ‘F’ for fluoroscopic, ‘T’ for therapeutic, and ‘O’ for other. If more space is needed, attach a separate sheet.

- Provide the maximum kVp, maximum mA, model name, serial number, manufacturer’s name, and the year installed for each x-ray unit listed.

- If responsible for x-ray units at other locations, list those locations in the provided space.

- Ensure the person responsible for radiation safety signs the form, including their title and the date signed in the specified format (mm/dd/yy).

- Review the registration fee information, prepare a check made payable to the Department of Health Services, and submit it along with the application.

- Finalize the process by saving any changes made, and consider downloading or printing a copy of the completed form for your records.

Complete your Form F47097 online today to ensure your x-ray devices are properly registered.

Filling out an export declaration form requires you to provide details about the goods being exported, their value, and destination. Be precise and include all required documentation for customs clearance purposes. If you feel uncertain, using easy templates, such as Form F47097, may help you navigate through the process without hassle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.