Get Department Of Taxation Va Form Edc 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of Taxation Va Form Edc online

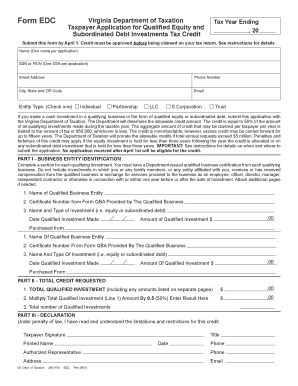

Filling out the Department Of Taxation Va form EDC can be a straightforward process when guided properly. This form is essential for those seeking credits for equity and subordinated debt investments in Virginia, ensuring you receive the appropriate tax benefits for your investments.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred digital editor.

- Enter the tax year ending, followed by your name, Social Security Number (SSN), or Federal Employer Identification Number (FEIN). Ensure that you provide only one name and SSN per application.

- Fill in your contact details including your street address, phone number, city, state, and ZIP code.

- Select your entity type by checking the appropriate option (individual, partnership, LLC, S Corporation, or trust).

- For each qualified business investment, complete Part I by providing the name of the qualified business entity, certificate number, the type of investment (equity or subordinated debt), and the date and amount of each qualified investment made.

- In Part II, calculate your total qualified investment amount and enter it in the designated field. Multiply this amount by 0.5 and record the result. Also, note the total number of qualified investments.

- Proceed to Part III and provide your signature, print your name, and fill in the date. Include your phone number and the authorized representative's details if applicable.

- Before finalizing, ensure to attach any necessary documents, including the qualified business certification and any required business entity statements.

- Finally, review all sections for accuracy, then save your changes, download, print, or share the completed form as required.

Complete your documents online today to ensure timely submission and proper processing of your tax credits.

If you need tax forms from the army, you should consult your unit administration office, as they typically have access to the Department of Taxation Va Form Edc and other relevant documentation. Additionally, military personnel can often access forms digitally through official military websites. If you seek an easy way to navigate tax-related documents, uslegalforms might help.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.