Get Where To Send Vermont Property Tax Publicpious Or Charitable Exemption Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Where To Send Vermont Property Tax Public, Pious or Charitable Exemption Application Form online

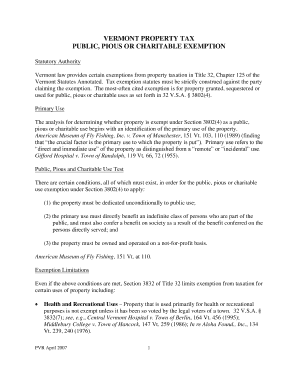

Filling out the Vermont property tax public, pious, or charitable exemption application form requires attention to detail and accurate information. This guide provides a straightforward approach to help users complete the form online with ease.

Follow the steps to complete the application form.

- Press the ‘Get Form’ button to access the application form and open it in your editor.

- Provide the property owner's information. Fill in the owner's name, mailing address, daytime phone number, and email address. If an attorney or agent represents the property owner, include their details as well.

- Attach required documents if the applicant is an organization. Include organizational documents, mission statement, IRS tax-exempt determination letter (if applicable), deed to the property, and any other relevant documents.

- Describe the property location. Fill in the town or city, school property account number (SPAN), street address, parcel size, and details of any buildings on the property.

- Provide information about the property’s primary use. Select the category that best describes the organization's mission. Describe the mission in detail and outline the primary and any incidental uses of the property.

- Indicate if the property is dedicated unconditionally to public, pious, or charitable use. Explain and provide supporting documentation.

- Clarify ownership and operation details. Confirm if the property is owned and operated by the same entity and, if not, provide a description of the operator.

- Document who benefits from the property. Specify if the property is open to the public and detail any usage restrictions.

- State if the property is not-for-profit. Provide information about any leases or rental agreements, and detail any fees associated with using the property.

- Complete the declaration section, sign the form, and print or save it according to your needs.

Ensure your property tax exemption application is ready to submit by completing your forms online today.

The form IN-111 is the Vermont income tax return used by residents to report their annual income. It’s essential to fill out this form accurately to ensure proper tax assessment. If you have questions or need clarification on the filing process, including details about where to send the Vermont Property Tax Public, Pious, or Charitable Exemption Application Form, resources such as the uslegalforms platform can provide valuable insights.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.