Loading

Get Wh 216 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wh 216 1 Form online

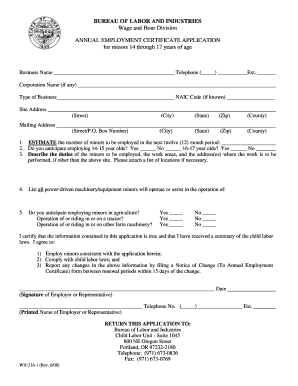

Filling out the Wh 216 1 form online is a straightforward process that allows employers to apply for annual employment certificates for minors aged 14 through 17. This guide will walk you through each section of the form to ensure you provide the necessary information accurately and efficiently.

Follow the steps to fill out the Wh 216 1 form online easily.

- Press the ‘Get Form’ button to obtain the Wh 216 1 form and open it in the online editor.

- Enter the business name and telephone number in the designated fields. If applicable, include the corporation name.

- Specify the type of business and the NAIC code if known. Fill in the site address, including street, city, state, zip code, and county.

- Complete the mailing address section, if it differs from the site address, by providing the relevant details.

- Estimate the number of minors you plan to employ over the next twelve months in the corresponding field.

- Indicate whether you anticipate employing 14-15 year olds and 16-17 year olds by checking 'Yes' or 'No' for each age group.

- Describe the duties of the minors to be employed, detailing the work areas and addresses where the work will be performed, if different from the site address. Attach additional locations as necessary.

- List all power-driven machinery or equipment that minors will operate or assist in operating.

- Indicate if you plan to employ minors in agriculture. Answer 'Yes' or 'No' for operating or riding in on a tractor and farm machinery.

- Review the certification statement ensuring all provided information is true. Affix the date and provide the signature of the employer or their representative, along with their printed name and telephone number.

- Once all relevant fields are filled, download or print the completed form for submission. Ensure you return the application to the Bureau of Labor and Industries as specified at the end of the form.

Start filling out the Wh 216 1 form online today for a smooth application process.

You can obtain the details required for Form 10IEA by visiting the CRA website that provides comprehensive instructions. These details will guide you through the required fields and compliance measures linked to your income as a non-resident. Pairing this information with the Wh 216 1 Form can help you maximize your tax efficiency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.