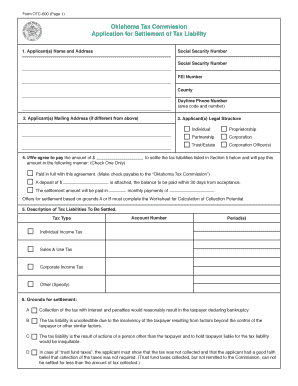

Get Otc Compromise Of Tax Liability Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Otc Compromise Of Tax Liability Form online

How to fill out and sign Otc Compromise Of Tax Liability Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you looking for a speedy and hassle-free way to complete the Otc Compromise Of Tax Liability Form at an affordable price? Our platform offers you an extensive selection of templates ready for online submission. It only takes a few minutes.

Follow these straightforward steps to prepare the Otc Compromise Of Tax Liability Form for submission:

Completing the Otc Compromise Of Tax Liability Form no longer has to be complicated. From this point on, simply handle it from your home or at the office using your mobile device or computer.

- Select the document you require from the collection of legal templates.

- Access the template in our online editor.

- Review the guidelines to understand what information you need to provide.

- Click on the fillable fields and enter the necessary information.

- Insert the appropriate date and add your electronic signature once you've filled out all other sections.

- Thoroughly review the finished document for typos and any other errors. If you need to modify any information, the online editing tool along with its comprehensive set of features is available for your convenience.

- Download the final form to your device by clicking on Done.

- Forward the electronic document to the necessary parties.

How to modify the Get Otc Compromise Of Tax Liability Form 2012: tailor forms online

Locate the appropriate Get Otc Compromise Of Tax Liability Form 2012 template and adjust it immediately.

Enhance your documentation process with an intelligent document modification tool for online forms.

Your daily routine with documentation and forms can be more efficient when you have everything you need in a single location. For example, you can search for, obtain, and modify the Get Otc Compromise Of Tax Liability Form 2012 all within one browser tab.

If you require a specific Get Otc Compromise Of Tax Liability Form 2012, you can effortlessly find it using the intelligent search engine and access it right away. There is no need to download it or seek out a separate editor to amend it and input your information. All necessary tools for efficient work are included in one comprehensive solution.

Make additional personalized adjustments with the available tools.

- This editing tool enables you to personalize, complete, and sign your Get Otc Compromise Of Tax Liability Form 2012 document instantly.

- Upon finding a suitable template, click on it to enter the editing mode.

- Once you have opened the form in the editor, all essential tools are readily available to you.

- You can conveniently fill in the designated fields and delete them if desired using a straightforward yet versatile toolbar.

- Instantly apply all changes and sign the document without leaving the tab by simply clicking the signature field.

International organizations can provide support in navigating complex tax situations, including tax liabilities. They often offer resources and frameworks that can assist in understanding tax policies. However, they may lack local knowledge or tailored solutions, which can be crucial in your case. When managing tax issues like those addressed by the Otc Compromise Of Tax Liability Form, consider the level of local expertise required.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.