Loading

Get Form 953 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

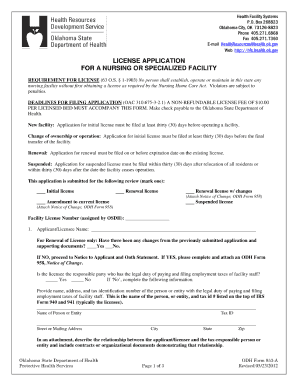

How to fill out the Form 953 online

Filling out Form 953 online can seem daunting, but with the right guidance, you can navigate through the process efficiently. This comprehensive guide will provide you with clear, step-by-step instructions to ensure that you successfully complete the form.

Follow the steps to fill out Form 953 accurately

- Click 'Get Form' button to obtain the form and access it in the editor.

- Begin by entering your personal information in the designated fields. Ensure that all details are accurate and up-to-date, including your name, address, and contact information.

- Proceed to fill out the relevant sections of the form. Each section requires specific information, so take your time and follow the prompts provided.

- Once you have completed all sections, review your entries to confirm that they are correct. Pay special attention to any required fields, as incomplete sections may lead to processing delays.

- When you are satisfied with your form, choose to save your changes. You may then download a copy, print it for your records, or share it as needed.

Complete your documents online now for a smooth filing experience.

Exemptions from the CA real estate withholding form 593 generally include certain sales involving primary residences and specific tax-exempt organizations. Understanding the criteria for exemption is crucial, as incorrect filings can lead to tax issues. Always ensure your reporting is accurate to avoid surprises. Resources like Form 953 provide clarity about these exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.