Loading

Get Nh Bt Ext

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Bt Ext online

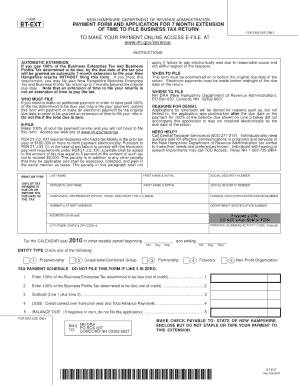

Filling out the Nh Bt Ext form online can seem daunting, but with clear guidance, you can navigate the process smoothly. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Nh Bt Ext form.

- Click the ‘Get Form’ button to access the Nh Bt Ext form and open it in your preferred editor.

- Begin by filling out your personal information in the designated fields. Make sure your name, address, and contact information are accurate and up-to-date.

- Next, you will need to provide any relevant identification numbers or reference details as required by the form. Ensure that you double-check these for accuracy.

- In this section, you will indicate the purpose of the document. Be clear and concise in your explanation to avoid any misunderstandings.

- Review the form to ensure all information is complete and correct. Any missing fields may lead to processing delays.

- Once you have confirmed that everything is in order, you may save your changes, download the completed form, print it, or share it as needed.

Start completing your Nh Bt Ext form online today to ensure a smooth submission process.

The NH business enterprise tax (BET) must be filed by businesses operating in New Hampshire that have gross receipts exceeding a specific threshold. This tax applies to both corporations and non-corporate entities, such as LLCs and partnerships. If your business falls under these criteria, it’s essential to comply with filing requirements to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.