Get Us Mortgage Loan Application Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Us Mortgage Loan Application Form online

Filling out the Us Mortgage Loan Application Form online can be a straightforward process if you approach it step-by-step. This guide will walk you through each section of the form to ensure that you provide accurate and complete information.

Follow the steps to complete your mortgage application online.

- Click 'Get Form' button to obtain the form and open it in the editor.

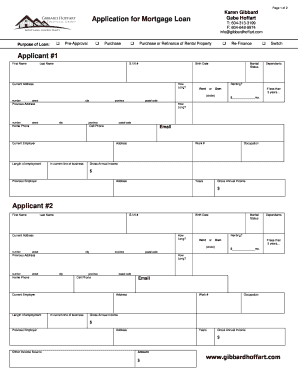

- Begin by entering the purpose of the loan. Indicate whether you are seeking pre-approval, purchasing a property, refinancing, or switching your mortgage.

- Complete the applicant #1 section by providing the first name, last name, social insurance number (S.I.N), birth date, current address, length of residency, marital status, and whether you are renting or owning your home.

- List the previous address if you have lived at your current address for less than three years, and indicate the number of dependents.

- Fill in the contact details, including home phone, cell phone, current employer, email address, length of employment, occupation, and gross annual income.

- Repeat the information for applicant #2 in the respective fields.

- Provide details regarding any other income sources and their amounts if applicable.

- In the personal net worth statement section, add assets such as cash, RRSP, stocks, term deposits, and their balances.

- List your liabilities, including names and balances of any loans, credit cards, and monthly payments required.

- If applicable, complete the refinance information for clients wishing to refinance existing property, including purchase price, property type, current mortgage holder, and other relevant details.

- Finally, certify the truthfulness of the information provided by signing and dating the application. Review the entire form for accuracy before submission.

- Once you are satisfied with the completed form, you can save changes, download it, print it, or share it as necessary.

Complete your Us Mortgage Loan Application Form online today for a seamless mortgage experience.

The 5 C's of mortgage lending consist of character, capacity, capital, collateral, and conditions. Character reflects your creditworthiness, while capacity assesses your ability to repay the loan. Capital refers to your assets and savings, whereas collateral involves the property securing the loan. Lastly, conditions consider the economic environment and lending regulations. Understanding these factors can enhance your Us Mortgage Loan Application Form experience and increase your chances for approval.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.