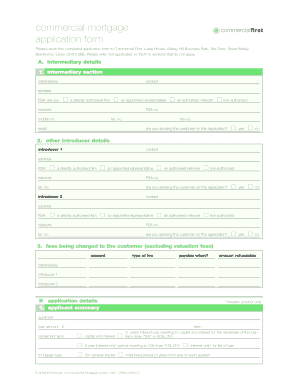

Get Commercial Mortgage Application Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Commercial Mortgage Application Form online

How to fill out and sign Commercial Mortgage Application Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still looking for a fast and easy solution to complete the Commercial Mortgage Application Form at an affordable cost?

Our service provides you with a wide array of templates available for online completion. It only requires a few minutes.

Filling out the Commercial Mortgage Application Form no longer has to be a hassle. From now on, you can easily complete it from your home or workplace directly from your smartphone or computer.

- Obtain the form you need from the collection of legal templates.

- Open the form in our web-based editor.

- Review the instructions to find out what information you need to provide.

- Choose the fillable sections and input the necessary details.

- Add the date and insert your electronic signature after you complete all other fields.

- Review the finished form for typos and other errors. If you need to modify any information, the online editor along with its extensive tools are at your disposal.

- Download the finalized document to your device by clicking Done.

- Send the electronic form to the designated recipient.

How to modify Get Commercial Mortgage Application Form 2015: personalize forms online

Select a trustworthy document editing service you can depend on. Revise, finalize, and authenticate Get Commercial Mortgage Application Form 2015 safely online.

Often, altering documents, such as Get Commercial Mortgage Application Form 2015, can be a hurdle, particularly if you received them in a digital format but lack access to specialized tools. While some workarounds exist, you risk producing a document that may not fulfill submission criteria. Utilizing a printer and scanner is not a viable solution either, as it consumes time and resources.

We provide a simpler and more effective method for completing forms. A vast library of document templates that are straightforward to modify and validate, making them fillable for some users. Our platform goes beyond just a collection of templates. One of the best features of our services is the ability to modify Get Commercial Mortgage Application Form 2015 directly on our website.

Being online-based, it spares you from downloading any application. Furthermore, not all corporate protocols permit downloading on your work computer. Here’s the most effective way to easily and securely process your documents with our solution.

Forget about paper and other ineffective methods of completing your Get Commercial Mortgage Application Form 2015 or other documents. Utilize our tool that merges one of the richest libraries of ready-to-modify forms with robust document editing services. It's simple and secure, and can save you a significant amount of time! Don’t just take our word for it, give it a go yourself!

- Click the Get Form > you’ll be swiftly directed to our editor.

- Once opened, you can commence the customization process.

- Select checkmark or circle, line, arrow, cross, and other options to annotate your document.

- Choose the date field to insert a specific date into your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to create and affix your legally-binding signature.

- Click DONE and save, print, and distribute or download the finished {file.

The minimum down payment for a commercial mortgage is generally between 15% and 30%, depending on the lender and the type of property. Larger or riskier investments may require higher down payments. When completing your Commercial Mortgage Application Form, be aware that your down payment affects not only your mortgage approval but also your monthly payment and interest rate.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.