Get Generic Commercial Mortgage Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Generic Commercial Mortgage Application Form online

Filling out the Generic Commercial Mortgage Application Form online is a vital step in securing financing for your commercial property needs. This guide provides clear, step-by-step instructions to help you navigate the form efficiently and accurately.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

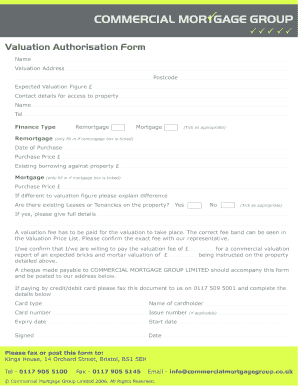

- In the intermediary details section, fill in the name and address of the intermediary, specifying if you are advising the customer on their application. Include contact numbers and email addresses as required.

- Detail any fees being charged by intermediaries or introducers, including the type of fee and when it is payable. Provide amounts and clarify if any fees are refundable.

- In the identity verification certificate section, list the names of applicants and guarantors, noting the methods of identification conducted. Ensure to sign and date the necessary evidence of identity.

- Complete the application details section, including the summary of applicants, purpose of the loan, and financial status. Provide information about any existing credit issues, income, and corroborate claims with documentation as needed.

- Fill out the personal details of borrowers and guarantors, ensuring to include names, addresses, voter registration status, and any children or dependents.

- Document employment details for all applicants, noting employer names, occupations, and income details. Include information regarding self-employment if applicable.

- In the property to be mortgaged section, indicate the purchase price, estimated value, intended use of the property, and confirm if any additional security is available.

- Complete the insurance, solicitor, and accountant information sections as applicable, providing contact details for both solicitors and accountants involved.

- Review your information in the application thoroughly. Once confirmed, save your changes. You can download, print, or share the completed form based on your requirements.

Ensure you have all your documents ready and begin completing your Generic Commercial Mortgage Application Form online today!

Typically, commercial mortgages have terms ranging from five to 20 years. Borrowers often enjoy fixed or variable interest rates, which can affect overall payment amounts. In many cases, lenders require a down payment of around 20% to 30%, depending on the property's value and the borrower's creditworthiness. When filling out a Generic Commercial Mortgage Application Form, it's crucial to understand these terms, as they will directly influence your financial planning and investment strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.