Loading

Get Mortgage Application Form 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the mortgage application form online

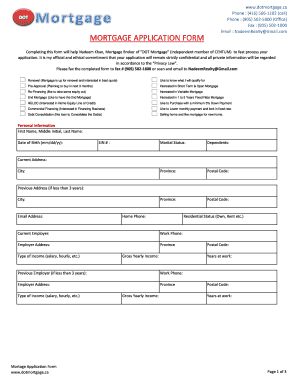

Completing the mortgage application form online is a straightforward process that helps streamline your mortgage application with DOT Mortgage. This guide will walk you through each section of the form, ensuring you understand what information is needed.

Follow the steps to accurately complete your application.

- Click the ‘Get Form’ button to access the mortgage application form and open it for editing.

- Begin by providing personal information. Fill in your first name, middle initial, and last name, followed by your date of birth in the format mm/dd/yy. Include your Social Insurance Number (SIN) and marital status, along with the number of dependents you have.

- Next, provide your current address, city, province, and postal code. If you've lived at your current address for less than three years, include your previous address and city as well.

- Enter your email address and home phone number. Specify your residential status, such as whether you own or rent your home.

- Detail your employment information. Include your current employer’s name, work phone number, and employer address alongside your province. Specify the type of income you receive (salary, hourly, etc.) and your gross yearly income, as well as the number of years you have been employed at your current job.

- If you have changed jobs within the last three years, provide details for your previous employer, including work phone number and address.

- Indicate how much loan you need and the current value of the property you are interested in.

- Complete the mortgage details section. Specify if you are applying for a first or second mortgage, including details of first and second mortgages held, such as the lender's name, balance, interest rate, monthly payment, and maturity date. Include monthly property taxes and other related financial details.

- List any liabilities you may have, such as credit card payments, loans, and monthly payments, alongside your assets including vehicles, cash savings, and any other properties.

- Answer any additional questions regarding your financial history, including bankruptcy declarations, personal loan guarantees, or co-signing on loans.

- Finally, review your application for accuracy and completeness. Provide your signatures and dates at the end of the application. Once satisfied, you can save the changes, download, print, or share the completed form.

Start filling out your mortgage application online today!

A mortgage form is a document that lenders use to collect necessary information from borrowers interested in obtaining a mortgage. This includes details like income, credit history, and the property being financed. Completing a Mortgage Application Form is a crucial step in this process, as it helps lenders assess your eligibility for a mortgage and tailor your options accordingly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.