Get Editable 1003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Editable 1003 online

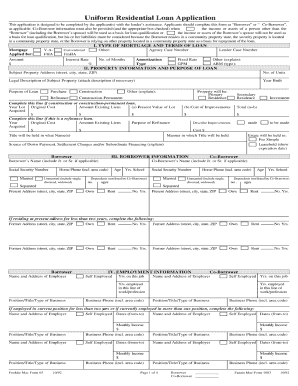

The Editable 1003 form is a key document used in the mortgage application process. This guide provides you with a clear understanding of how to fill out the form effectively and accurately online.

Follow the steps to complete your Editable 1003 online

- Click 'Get Form' button to access the Editable 1003 form and open it in your web browser.

- Begin by entering your personal information. This section typically includes details such as your name, address, and contact information. Ensure that all information is accurate and current.

- Next, you will fill out the loan information section. Provide details such as the loan amount requested, purpose of the loan, and the type of mortgage. Be specific to avoid processing delays.

- Move on to the employment history section. List your current employment details along with any previous employment in the specified format. Include employer names, addresses, and duration of employment.

- The financial information section requires you to input your income and asset details. Make sure to include all sources of income and current assets that you own.

- Provide information about your debts. This includes any loans, credit cards, or other liabilities. Being thorough in this section will help lenders assess your financial health.

- Review the disclosure and signature sections to ensure you understand and agree to the terms provided. Be sure to sign and date the form where indicated.

- Finally, once all fields are filled out correctly, you can save your changes, download the form, print it, or share it as needed.

Start completing your documents online today for a smooth application process.

Related links form

Fannie Mae, or the Federal National Mortgage Association, plays a crucial role in the U.S. mortgage market. It is a government-sponsored enterprise that helps provide liquidity to mortgage lenders by buying mortgages and issuing mortgage-backed securities. With Fannie Mae, lenders can service more loans, which makes home financing more accessible for buyers. By simplifying processes with tools like the Editable 1003, the company aims to enhance efficiency for all parties involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.