Get What Is Miscellaneous Exempt On Property Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Miscellaneous Exempt On Property Tax Form online

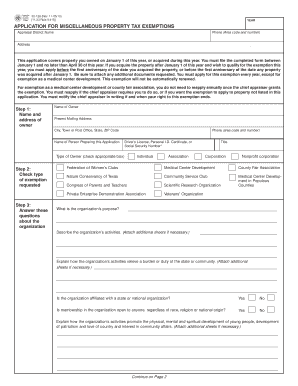

Filing for miscellaneous property tax exemptions can be a straightforward process if you have the right guidance. This guide provides clear, step-by-step instructions to help you complete the What Is Miscellaneous Exempt On Property Tax Form online effectively.

Follow the steps to successfully complete the form online

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Fill in the year for which you are applying for the exemption in the designated field.

- Provide the name and address of the property owner, including the phone number and mailing address.

- Indicate the type of owner by checking the appropriate box: individual, corporation, nonprofit, etc.

- Select the type of exemption you are requesting by checking the relevant box in the provided section.

- Answer all questions about the organization to ensure eligibility. Provide detailed descriptions where necessary.

- If applicable, complete the County Fair Association section, answering all specific questions regarding the association's operations.

- In the property description section, list all properties to be exempt and attach any required schedules for real and personal property.

- Ensure all attached documents, including charters and bylaws, are complete and certify the information provided is accurate.

- Sign the application on behalf of the organization, include the date and title of the signatory.

- Review your completed form for accuracy, and then save changes, download, print, or share the filled form as needed.

Start completing your documents online today to take advantage of available property tax exemptions.

Related links form

In Massachusetts, seniors do not automatically stop paying property taxes at a certain age; however, they may become eligible for exemptions as they reach age 65. These exemptions can significantly reduce their tax liabilities. It is vital for seniors to stay informed about the available tax relief options. Checking the miscellaneous exemptions on the property tax form allows seniors to effectively manage their tax responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.