Loading

Get Rp 467 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 467 Form online

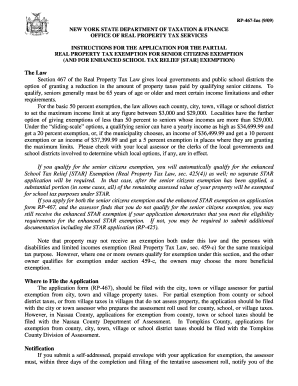

The Rp 467 Form is an essential document for senior citizens seeking a partial property tax exemption. This guide will provide clear, step-by-step instructions for completing the form online, ensuring that users understand each section and requirement.

Follow the steps to fill out the Rp 467 Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the names of all owners of the property. Ensure that any required documentation, such as the deed or mortgage, verifies ownership.

- Provide the accurate location of the property, matching the description from the latest assessment roll. If needed, consult your assessor for assistance.

- Verify the age of each owner. Each owner must be at least 65 years old, except in specific situations such as when owners are spouses or siblings.

- Document the length of ownership. Indicate whether a prior property received an exemption or confirm title vested for at least 12 months before filing.

- Include proof of ownership by attaching documents like a deed or mortgage agreement showing title ownership.

- Ensure that the property is occupied by its owners. If an owner is temporarily absent due to specific conditions, note these exceptions.

- Confirm that the property is used exclusively for residential purposes. If any part is used for other purposes, the exemption will only apply to the residential part.

- Report income for all owners. Ensure compliance with the income limits set by your locality, and include all relevant income sources.

- If applicable, provide proof of income eligibility and necessary adjustments, such as medical expenses, by including supporting documentation.

- Attach a copy of your latest federal or New York State income tax return as part of the application.

- Once all information is complete, review the form for accuracy, save your changes, and prepare to submit the application.

- Download, print, or share the completed form as needed. Remember to file the form with the appropriate local assessor's office.

Complete your RP-467 form online today to secure your property tax exemption.

In New York, certain individuals such as veterans, seniors, and people with disabilities may qualify for exemptions from property taxes. Each exemption has specific requirements, so it's important to verify your eligibility. Filing the RP 467 Form is a significant step in determining if you can benefit from these tax exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.