Loading

Get Irs Form 3881

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 3881 online

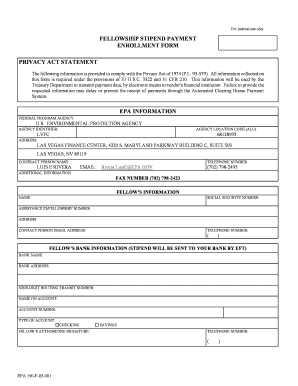

Filling out the Irs Form 3881 online can streamline your filing process and ensure timely payment. This guide will walk you through each section of the form, providing clear instructions to help you complete it accurately.

Follow the steps to fill out the Irs Form 3881 online:

- Press the ‘Get Form’ button to obtain the form and open it in your digital editor.

- Under ‘Fellow's Information,’ enter your name in the designated field.

- Provide your Social Security Number in the next section.

- Input your Assistance ID/Fellowship Number, which typically begins with U, FP, or MA, as found on the top center of your Fellowship Agreement.

- Fill in your mailing address in the appropriate field.

- Enter your email address followed by your telephone number.

- Move to the ‘Fellow’s Bank Information’ section.

- Type in the name of your banking institution.

- Provide the complete address of your banking institution.

- Enter your nine-digit routing transit number.

- Specify the name under which the bank account is held.

- Input your bank account number.

- Indicate the type of account by selecting either Checking or Savings.

- Affix your signature and add your telephone number.

- Once all required fields are filled, you can save changes, download, print, or share your completed form.

Complete your documents online today to ensure accurate and efficient processing.

The ACH form is typically filled out by the individual or business initiating the payment. This ensures that all necessary information is accurate and complete. If you are managing transactions using IRS Form 3881, it is crucial for you, as the account holder, to take responsibility for this process. Services like USLegalForms can make this task straightforward by providing the proper resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.