Loading

Get Us Bank Application For Lender Approval Form 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Us Bank Application For Lender Approval Form online

Filling out the Us Bank Application For Lender Approval Form online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide will walk you through each section of the form, providing step-by-step instructions to ensure that you complete it accurately and efficiently.

Follow the steps to complete the application form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

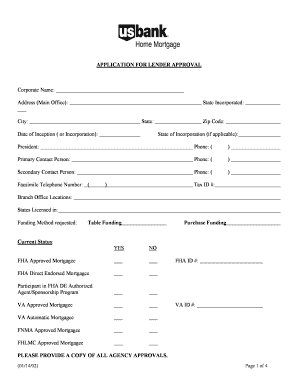

- Begin by entering your corporate name and address details including the main office's city, state, zip code, and state of incorporation. Ensure that all contact information is accurate.

- Provide details regarding the president of your organization and their contact information. Include the primary and secondary contact persons along with their phone numbers.

- Indicate the funding methods requested, whether it be table funding or purchase funding. Fill out the relevant sections concerning branch office locations and the states you are licensed to operate in.

- Complete the section regarding current status. Confirm whether your institution is an FHA or VA approved mortgagee and provide the respective ID numbers if applicable.

- Answer the question regarding previous applications that were denied, providing reasons if applicable. Follow this with your statistics on residential loans sold for the past and current year, ensuring to include the percentage breakdown for different loan types.

- Complete the references section, including contact details for current and previous investors and relevant mortgage insurance companies.

- Prepare the necessary documents required to support your application. This includes auditor statements, board resolutions, insurance evidence, and any required policies.

- Provide personal information for principal officers, including their date of birth, title, social security number, residential address, and ownership percentage.

- Affirm that all provided information is true and authorizes U.S. Bank N.A. to conduct necessary verification steps. Sign, date, and state your name and title at the end of the form.

- For applications involving wire transfers, complete the wire transfer information section including the depository name, address, and ABA number, along with the details for crediting.

- After filling out the entire form, review all fields for accuracy. Once you confirm that all information is correct, proceed to save your changes and download, print, or share the form as needed.

Complete your application online today to streamline your lender approval process.

Filling out the US Bank Application For Lender Approval Form is straightforward. Begin by gathering all necessary documents, such as identification and income verification. Next, carefully enter your personal information, financial details, and any required disclosures. Make sure to double-check your entries before submission to ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.