Loading

Get Pgh 40 2012 Form 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PGH-40 2012 Form online

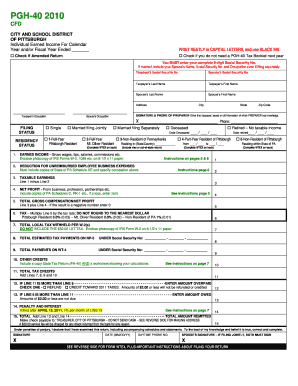

Completing the PGH-40 2012 Form is an important step for individuals who need to report their earned income to the City of Pittsburgh. This guide provides a step-by-step approach to filling out the form online, ensuring clarity and support throughout the process.

Follow the steps to successfully complete the PGH-40 2012 Form online.

- Click ‘Get Form’ button to obtain the PGH-40 2012 Form and open it in your preferred online editor.

- Begin by entering your complete 9-digit Social Security Number in the designated field. If you are married, include your spouse’s name, Social Security Number, and occupation, even if you are filing separately.

- Fill in the taxpayer's last name and first name, followed by the spouse's last name and first name if applicable. Ensure that you use capital letters and black ink for clarity.

- Provide the address, including the city, state, and zip code. This information is necessary for identification and processing of your return.

- Select your filing status by checking the appropriate box for either single, married filing jointly, married filing separately, or deceased if applicable.

- Indicate your residency status by checking the relevant option such as full-year Pittsburgh resident or non-resident of Pennsylvania.

- Report your earned income, including gross wages, tips, and salaries. Attach photocopies of IRS Forms W-2 or 1099 on 8.5 x 11 paper as required.

- If applicable, enter your net profit from business activities or partnerships and attach any required schedules.

- Complete section for deductions related to unreimbursed employee business expenses by including copies of the State Schedule UE and specify your occupation.

- Calculate your total gross compensation by combining your net profit and earned income from previous sections.

- Multiply your total gross compensation by the relevant tax rate based on your residency status.

- Fill in the total local tax withheld per W-2, ensuring not to include the local service tax.

- If you have any tax credits or payments indicated, be sure to report those in their respective sections.

- Determine if you have an amount overpaid or owed based on your calculated tax credit versus tax due.

- Sign and date the form, ensuring both partners sign if filing jointly. Include your daytime phone number.

- After completing the form, review it for accuracy, then save your changes, and prepare to print or share it as needed.

For seamless processing, complete your PGH-40 2012 Form online today.

The form used for PA estimated tax payments is typically the PA 40ES. This form allows taxpayers to estimate their state tax obligations based on income during the year. To streamline your tax process, consider how the PA 40ES form interacts with the Pgh 40 2012 form in your overall tax strategy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.