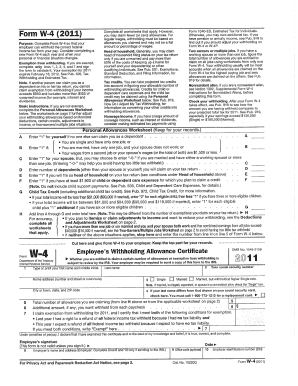

Get Form W 4 For Year 2011 & 2012 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W 4 for year 2011 & 2012 online

Filling out the Form W 4 for the years 2011 and 2012 can seem daunting, but with this step-by-step guide, you will navigate the process with ease. This form is essential for determining the amount of federal income tax to withhold from your paycheck.

Follow the steps to complete your Form W 4 online.

- Click the ‘Get Form’ button to access the form and open it for completion.

- Provide your personal information in the designated fields. This includes your name, social security number, and address. Ensure that all details are accurate to prevent any issues with tax withholding.

- Indicate your tax filing status by selecting the appropriate checkbox. Options typically include single, married filing jointly, married filing separately, or head of household. Choose the option that best reflects your situation.

- In the next section, determine any deductions and if you are eligible for additional withholding. This may involve adding extra amounts or indicating if you plan to claim dependents. Carefully read the instructions to maximize your deductions.

- Review all provided information for accuracy. Ensure that all sections are filled out as required. Mistakes can lead to incorrect withholdings.

- Once all fields are complete, you can save your changes. You have the option to download, print, or share the form as needed for your records.

Complete your documents online today to ensure accurate tax withholdings!

The best tax withholding percentage for a single person varies based on individual financial circumstances, but guidance can be found using Form W 4 For Year 2011 & 2012. Generally, single individuals may benefit from estimating their yearly income, taking into account potential deductions. You can use this form to adjust your withholding to suit your financial goals while minimizing surprises at tax time. Consider consulting with a tax professional to tailor the withholding percentage to your unique situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.