Loading

Get 2011 W 9 Form 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 W 9 Form online

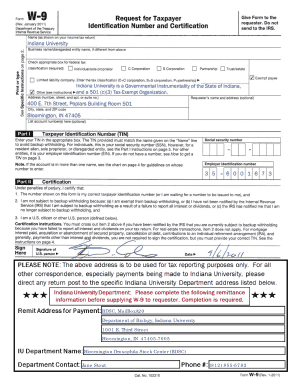

Filling out the 2011 W 9 Form online can streamline your process for providing taxpayer information. This guide offers detailed, step-by-step instructions tailored to ensure accuracy and completeness.

Follow the steps to accurately complete the 2011 W 9 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your name as it appears on your tax return. If you are filling it out for a business, include the business name as well.

- Next, check the appropriate box for your federal tax classification. This may include categories such as individual, corporation, partnership, or other types.

- Input your address in the designated fields. Ensure that the street address, city, state, and zip code are all correctly entered.

- If applicable, complete the section for exempt payee code if you are an exempt payee; otherwise, leave this blank.

- In the Taxpayer Identification Number (TIN) field, provide either your Social Security number or Employer Identification Number.

- Review the certification section. Here, you will need to sign and date the form, confirming that the information provided is accurate.

- Finally, save changes to your document. You can download, print, or share the form as needed.

Complete your documents online today for a more efficient experience.

Yes, it is generally safe to send a 2011 W 9 Form, especially when you follow proper security measures. Always ensure you send this form through secure channels to protect your personal information. Using trusted platforms, like USLegalForms, can provide peace of mind as they maintain high security standards for document transmission. Remember, handling the 2011 W 9 Form with care will help safeguard your sensitive details from unauthorized access.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.