Loading

Get Ks W4 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ks W4 online

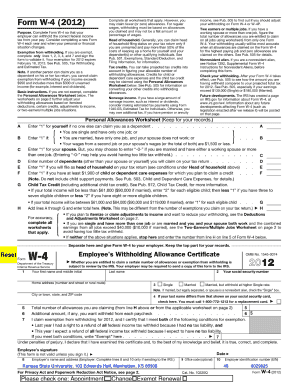

The Ks W4 form is essential for individuals to indicate their tax withholding preferences. This guide will walk you through the process of filling out the form online, ensuring accuracy and compliance.

Follow the steps to complete your Ks W4 form with ease.

- Click ‘Get Form’ button to access the Ks W4 form and open it in the editing interface.

- Begin by entering your personal information in the designated fields, including your name, address, and Social Security number. Ensure that all entered data is accurate and up to date.

- Indicate your filing status by selecting the appropriate option from the provided choices. This is necessary for calculating your withholding amounts correctly.

- Complete the section for allowances by following the instructions carefully. You may need to refer to the accompanying guidance to determine the number of allowances you are eligible to claim.

- If applicable, fill in any additional adjustments, such as extra withholding amounts or other considerations that might affect your tax situation.

- Review all the information entered to ensure accuracy and completeness. Mistakes in the form can lead to incorrect withholding or tax liabilities.

- Once you have verified your information, proceed to save your changes. You may also download, print, or share the completed form as needed.

Complete your Ks W4 form online today for streamlined tax withholding management.

When filling out the Ks W4 form, determining the number of allowances depends on your personal situation. Consider factors such as your marital status, number of dependents, and any additional income you may have. It’s important to strike a balance to avoid owing taxes at the end of the year or having too much withheld from your paycheck. If you are unsure, using a tax calculator or consulting with a tax professional can provide clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.