Loading

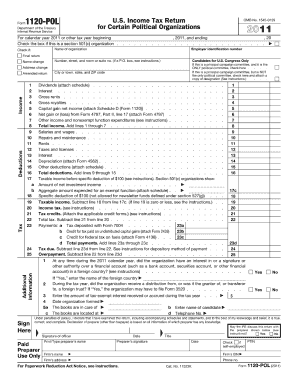

Get 1120 Pol 2011 Form 2016-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1120 Pol 2011 Form online

Filling out the 1120 Pol 2011 Form online can seem daunting, but with the right guidance, it can be a smooth process. This comprehensive guide will provide you with step-by-step instructions to help you complete the form accurately.

Follow the steps to fill out the 1120 Pol 2011 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Review the instructions provided on the form. Each section has specific requirements, so understanding these details is critical for accurate completion.

- Begin filling out the identification section with relevant information about your organization, including the name, address, and Employer Identification Number.

- Move on to the financial information section. Here, you will need to input accurate financial data including revenue, expenses, and net income for the relevant period.

- Complete the section concerning deductions. Follow the prompts to ensure all applicable deductions are duly noted to minimize taxable income.

- Ensure you review all entered data for accuracy. Double-check each section for mistakes or inaccuracies to avoid potential delays or issues.

- Once you are satisfied with the information provided, you can save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your 1120 Pol 2011 Form online today and ensure your submission is accurate and timely.

Form 1120 W is a worksheet used for estimating tax payments for corporations that plan to file form 1120. It assists corporations in computing estimated tax payments based on prior business income and expected current year revenues. Utilizing the 11 Form alongside 1120 W helps businesses analyze their tax liabilities and prepare effectively for tax deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.