Loading

Get Form 13551 2012-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13551 online

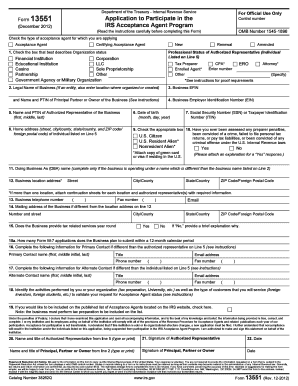

This guide provides users with detailed instructions on how to complete Form 13551, an application to participate in the IRS Acceptance Agent Program. Filling out this form online can be straightforward with the right guidance.

Follow the steps to fill out Form 13551 online.

- Click the ‘Get Form’ button to access the form and open it in your online document editor.

- Review the instructions carefully before proceeding to ensure you understand each section of the form.

- Select the type of acceptance agent you are applying for by checking the appropriate box: Acceptance Agent, Certifying Acceptance Agent, New, Renewal, or Amended.

- Provide the organization status by checking the box that best describes your business type, such as Sole Proprietorship, Corporation, or Educational Institution.

- Enter the Legal Name of Business in Line 2, and if applicable, include the location where it was organized.

- Input the Business Employer Identification Number (EIN) and the Preparer Tax Identification Number (PTIN) of the Principal Partner or Owner.

- Complete the information for the Authorized Representative, including full name, date of birth, and PTIN.

- Specify the social security number or Taxpayer Identification Number of the Authorized Representative.

- Fill in the home address of the individual listed as the Authorized Representative.

- Indicate whether the individual is a U.S. Citizen or Resident Alien, and if applicable, attach a copy of the green card or visa.

- If applicable, provide a Doing Business As (DBA) name and address for the business location.

- Enter the business telephone and fax numbers, along with an email address for contact purposes.

- Check whether the business provides tax-related services year-round. If 'No', briefly explain.

- Mention how many Form W-7 applications you anticipate submitting in the next 12 months.

- If the Primary Contact differs from the Authorized Representative, complete their details and provide their contact information.

- Describe the activities performed by your organization to validate your acceptance agent status request.

- If you wish to be included on the IRS published list of Acceptance Agents, check the respective box.

- Print and sign the application where indicated, ensuring it is signed by both the Authorized Representative and the Principal, Partner, or Owner.

- Save changes, download, print, or share the form as needed.

Start filling out your applications online today to ensure a smooth process.

To fill out a service request form, start by writing your basic contact information at the top. Next, describe the service you need clearly and succinctly. Ensure you mention any pertinent details, such as deadlines or required documents like Form 13551. Finally, review everything for clarity and completeness to avoid any confusion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.