Get 401k Enrollment Form 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401k Enrollment Form online

Completing the 401k Enrollment Form online is a crucial step towards securing your financial future. This guide provides comprehensive instructions to help you navigate the form efficiently, ensuring that all necessary information is correctly submitted.

Follow the steps to successfully complete your 401k Enrollment Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

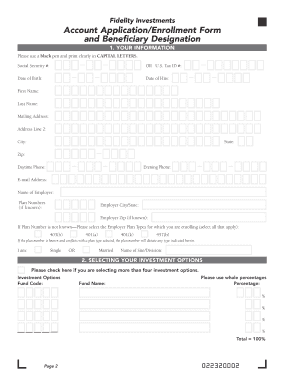

- Begin with filling out your personal information. Use a black pen and print clearly in capital letters for accuracy. This includes your Social Security number or U.S. Tax ID, date of birth, date of hire, name, address, and phone numbers.

- In the section for selecting your investment options, indicate how you want your contributions allocated. Use whole percentages, ensuring that the total equals 100%. If you choose more than four options, document them separately.

- Designate your beneficiary or beneficiaries in the specified fields. You can assign more than two primary and two contingent beneficiaries. Make sure the total allocation for primary beneficiaries is 100%.

- If you are married, complete the spousal consent section. Your spouse must sign this section in the presence of a notary public or a plan representative.

- Provide your signature in the authorization section, confirming the accuracy of the information provided and your understanding of the implications of your selections.

- Finally, save your changes and you may choose to download, print, or share the completed form as needed.

Take the next step in planning your financial future by completing your 401k Enrollment Form online today.

A 401k distribution request form is a document you fill out to initiate a withdrawal from your retirement savings account. This form provides information on how much you want to withdraw and how you would like to receive your funds. It’s important to understand the tax implications of withdrawals before you submit this form. Make sure you consult your plan's guidelines for any specific requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.