Loading

Get Us Trustee Summary Form 22c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Us Trustee Summary Form 22c online

Filling out the Us Trustee Summary Form 22c online can be a straightforward process when approached step-by-step. This guide will help you understand each section of the form, ensuring that you provide accurate information essential for determining disposable income under chapter 13.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

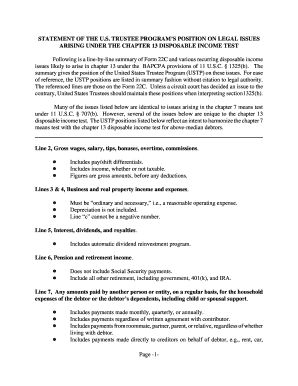

- Begin by entering gross wages, salary, tips, bonuses, overtime, and commissions on Line 2. This amount should reflect total earnings before any deductions.

- For Lines 3 and 4, include business and real property income and ensure expenses listed are ordinary and necessary. Remember that depreciation is not counted.

- On Line 5, report interest, dividends, and royalties, including any automatic dividend reinvestment.

- For Line 6, include all retirement income except Social Security. This should cover pensions, government plans, 401(k), and IRAs.

- Enter on Line 7 any amounts paid by others that contribute to household expenses, irrespective of any agreements.

- Include unemployment compensation on Line 8, noting that it should not be treated as a benefit under Social Security.

- For Line 9, report any income from other sources like cash gifts or gambling winnings, while ensuring that what does not qualify is excluded.

- Continue to fill in relevant details about marital adjustments on Line 13 and apply the relevant median family income information on Line 16.

- Proceed through the remaining lines to list all necessary expenses as guided and ensure compliance with USTP positions.

- After completing all sections, review your entries for accuracy, then save your changes, download, print, or share the form as necessary.

Start completing your Us Trustee Summary Form 22c online today.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.