Get Nfip Fillable Flood Policy Cancellation And Nullification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nfip Fillable Flood Policy Cancellation And Nullification Form online

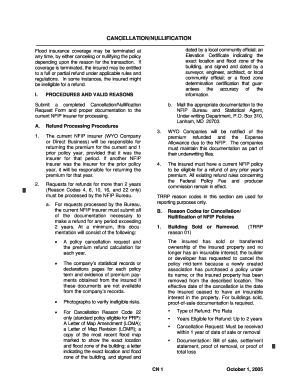

This guide provides a comprehensive overview for users on how to fill out the Nfip Fillable Flood Policy Cancellation And Nullification Form online. Whether you are canceling or nullifying your flood policy, following the instructions will ensure a smooth process.

Follow the steps to complete your form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the upper right corner, enter your current NFIP policy number.

- Indicate the policy term and specify the cancellation effective date.

- Provide the complete name, mailing address, phone number, and fax number of your insurance agent.

- Enter the complete name, mailing address, and phone number of the insured. If they have changed location, include the new address.

- List the complete location of the insured property.

- Select the reason for cancellation from the available options and provide any additional information as required.

- Specify who the refund should be made payable to by checking the appropriate box and indicate where it should be mailed.

- The insured must sign and date the form unless it is due to reason codes 5 and 6. The producer must also sign and enter their Tax I.D. Number or Social Security Number.

- Attach all required supporting documents and send the original form to the NFIP. Keep copies for your records.

- After processing, the NFIP will send a notice of cancellation to the producer, mortgagee, and insured.

Fill out your Nfip Fillable Flood Policy Cancellation And Nullification Form online today for an efficient processing experience.

Flood risk encompasses various components, including the likelihood of flooding in your area, the elevation of your property, and your proximity to water bodies. These factors play a significant role in determining your insurance needs. Understanding your flood risk allows you to make smart choices about coverage and protection. When you need to make changes to your flood policy, consider using the Nfip Fillable Flood Policy Cancellation And Nullification Form for an efficient process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.