Loading

Get Form 3621 Irs 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3621 Irs online

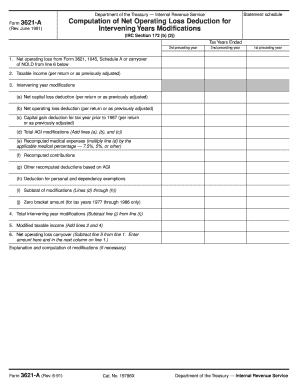

Form 3621 is an important document used for computing net operating loss deductions for tax purposes. This guide will walk you through the process of filling out Form 3621 online, ensuring that you understand each component and section for accurate completion.

Follow the steps to complete Form 3621 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by identifying the tax years for which you are claiming net operating loss deductions. You will need to fill in the years in the designated sections.

- Enter the net operating loss from Form 3621, Schedule A, or the carryover of net operating loss deduction from line 6 into line 1.

- For line 2, input the taxable income as indicated on your return or as previously adjusted.

- Proceed to line 3, where you will detail any intervening year modifications. For each sub-item (a to j), provide the applicable deductions and adjustments based on your previous returns.

- Complete line 4 by calculating the total intervening year modifications. This is done by subtracting the zero bracket amount (line j) from the subtotal of modifications (line i).

- Fill out line 5 by adding your taxable income (line 2) to your total intervening year modifications (line 4).

- On line 6, determine the net operating loss carryover by subtracting your modified taxable income (line 5) from net operating loss (line 1). Enter this amount here and in the next column on line 1.

- If necessary, provide explanations and computations for any modifications in the section at the bottom of the form.

- Once all fields are filled out, review your entries for accuracy, then save changes, download the completed form, and print or share it as needed.

Start filling out your Form 3621 online today to ensure accurate documentation for your tax return.

Filing Form 3921 online is similar to using electronic filing for other IRS forms. Choose an IRS-approved e-file provider, input the necessary details for the form, and follow the steps for submission. Always confirm the submission is successful, as you would with Form 3621 IRS, to avoid any misunderstandings with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.