Loading

Get Form 13711 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13711 online

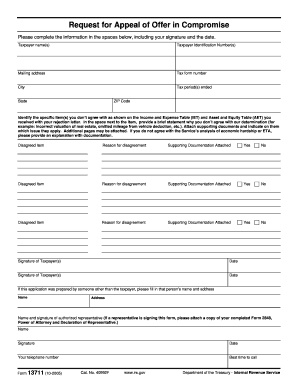

Form 13711 is designed for users who wish to appeal the rejection of their Offer in Compromise. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently in an online format.

Follow the steps to successfully complete your Form 13711.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by entering the taxpayer name(s) and their corresponding Taxpayer Identification Number(s) in the designated fields.

- Provide your current mailing address, including city, state, and ZIP code.

- Enter the relevant tax form number and the tax period(s) that have ended.

- Identify each item from the Income and Expense Table (IET) and Asset and Equity Table (AET) that you disagree with. In the adjacent space, briefly explain the reason for your disagreement.

- Indicate whether you have attached supporting documentation for each disagreed item by checking 'Yes' or 'No'. Make sure to label the documents clearly with the corresponding issue.

- If applicable, have the taxpayer(s) sign and date the form in the provided signature fields.

- If this application was prepared by someone other than the taxpayer, fill in the preparer's name and address as well.

- If an authorized representative is signing the form, include their name and signature, and attach a copy of Form 2848, Power of Attorney and Declaration of Representative.

- Finally, provide your telephone number and the best time to contact you. Review all entered information for accuracy.

Complete your Form 13711 online today to ensure a timely appeal process.

Writing a letter of forgiveness to the IRS requires you to be heartfelt and sincere. You should explain your circumstances and provide any supporting evidence that justifies your request for leniency. If applicable, refer to Form 13711 to guide your letter's structure and ensure that you cover all necessary details.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.