Loading

Get Irs Form 6040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 6040 online

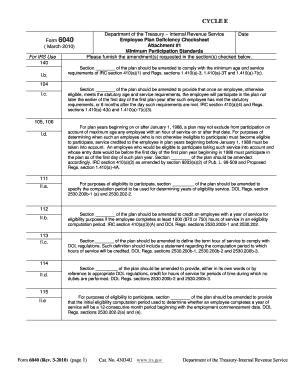

Filling out the IRS Form 6040 is an important process for ensuring compliance with employee plan requirements. This guide provides a clear, step-by-step approach to help users easily complete the form online.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred editing application.

- Begin by entering the date in the designated field. Ensure that the date is accurate and in the correct format.

- Review the sections that require amendments. Use specific references in the space provided to indicate which sections of the plan should be amended for compliance with minimum participation standards.

- Complete the fields that require details about eligibility provisions. Specify the computation period and amend sections based on the plan's unique requirements.

- Enter information related to hours of service in the appropriate sections. Include details about how eligibility will be measured and any break in service definitions.

- Once all necessary information is filled out, review the entire form for accuracy. Ensure that all amendments and definitions comply with IRS regulations.

- After finalizing the form, save your changes. You will have options to download, print, or share the completed form as needed.

Complete your IRS Form 6040 online today for a smooth filing experience.

To get IRS information, visit the IRS website, where you can access a wealth of resources online. You can also call the IRS helpline or request your tax transcripts using Form 4506-T. Remember to have your personal details handy for a smoother process. Services like UsLegalForms can provide additional guidance to ensure you obtain all necessary IRS information effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.