Loading

Get 941 Pr 2011 Form 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 941 Pr 2011 form online

Filling out the 941 PR 2011 form online can streamline your tax reporting process. This guide provides a step-by-step approach to ensure accurate completion of the form, helping you meet your tax obligations efficiently.

Follow the steps to complete the 941 Pr 2011 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

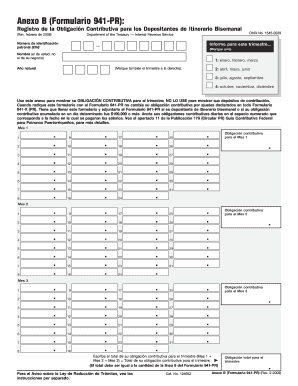

- Begin by entering your employer identification number (EIN) at the top of the form. This unique number is essential for identifying your tax account.

- In the section indicating the quarter, mark the appropriate box to denote the months of January to March, April to June, July to September, or October to December for the year.

- Report your contribution obligation for each month of the quarter in the designated fields. Ensure that the amounts correspond to the specific days you paid wages.

- Calculate the total contribution obligation for the quarter by adding the individual monthly obligations. Enter this total in the specified box, ensuring it matches line 8 of the 941 PR form.

- Review all the entered information for accuracy, as this will be used for your tax report.

- Once satisfied with the information, you can save changes, download, print, or share the completed form as necessary.

Start filling out your 941 PR 2011 form online to ensure compliance and accuracy in your tax reporting.

The term '941' refers to the IRS form used by employers to report payroll taxes. It's called 941 because it is filed quarterly, allowing you to reflect income taxes withheld and employer payroll taxes. Accurate completion of the 941 Pr 2011 Form is vital for meeting your tax responsibilities. With US Legal Forms, you can access all necessary forms and guidance to support your filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.