Loading

Get Estate Accounting Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estate Accounting Forms online

Filling out the Estate Accounting Forms online can seem like a daunting task, especially for those new to estate management. However, with a clear understanding of each section and field of the form, the process can be straightforward and manageable.

Follow the steps to complete the Estate Accounting Forms online:

- Locate the ‘Get Form’ button to begin the process of obtaining the Estate Accounting Form and open it in the editor.

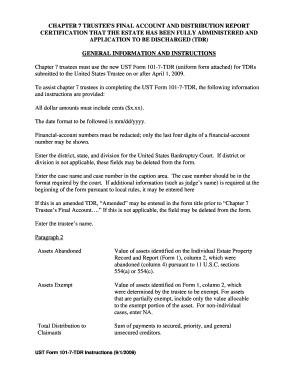

- Enter the relevant case information in the caption area, including the case name and number formatted per court requirements.

- Indicate whether the form is an amended TDR by adding ‘Amended’ before the title, if applicable.

- Provide your name as the trustee in the designated section.

- Complete the section for assets abandoned by entering their value as indicated in the Individual Estate Property Record and Report.

- Fill in the value of exempted assets, ensuring to report only the value attributable to the exempt portion.

- Calculate and enter the total distribution made to claimants, combining secured, priority, and general unsecured creditors.

- Report any claims discharged without payment and ensure to adhere to the court's requirements for adjustments.

- Sum the total expenses of administration and provide details as necessary.

- List gross receipts, funds paid to the debtor and third parties, net receipts, and provide a summary of claims chart.

- Complete details concerning the original chapter filed, the date the case was originally filed, and pertinent dates related to chapter 7.

- Sign and date the form at the designated area, ensuring your signature is formatted correctly.

- Attach all required exhibits and ensure they comply with the specified formats for Exhibits 1 through 9 as detailed in the form instructions.

- Finally, save your changes, and options to download, print, or share the completed form will be available.

Complete your Estate Accounting Forms online today, ensuring a smoother and more efficient filing process.

The chart of accounts for an estate is a structured list of all accounts used to manage an estate's financial activities. It typically includes categories for assets, liabilities, income, and expenses, allowing for organized record-keeping. Incorporating a chart of accounts in your estate accounting forms can simplify your financial reporting and enhance clarity for all stakeholders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.