Loading

Get Irs Form 6123

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 6123 online

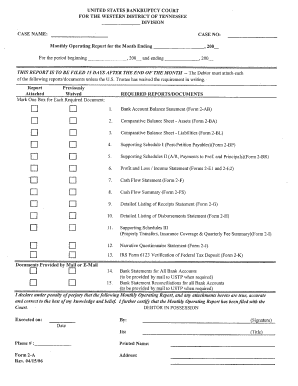

Filling out the IRS Form 6123 online can streamline your document management process. This guide provides step-by-step instructions to help users navigate each section of the form confidently.

Follow the steps to complete the IRS Form 6123 efficiently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Review the form’s sections which typically include applicant information and details about the purpose of the form. Ensure you have all necessary details at hand before proceeding.

- Enter your full name and contact information in the designated fields. Make sure that the information is accurate and up-to-date.

- Provide any required identification numbers, such as your Social Security Number (SSN) or Employer Identification Number (EIN), in the specified sections.

- Fill out the part that pertains to the reason for submitting the form. Clearly state the purpose in the provided text box.

- Review all the information you have entered to verify its accuracy. Ensure there are no typographical errors that could cause delays.

- Once you have completed the form, look for options to save changes, download, print, or share the filled-out document as needed.

Complete your IRS Form 6123 online today to ensure timely processing of your document.

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, required minimum distributions (RMDs), and the fair market value (FMV) of the account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.