Loading

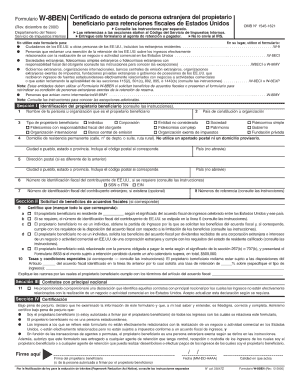

Get Omb No 1545 1621

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Omb No 1545 1621 online

Filling out the Omb No 1545 1621 form is a crucial step for many users in managing their documentation effectively. This guide will provide you with clear, step-by-step instructions to complete the form online with confidence.

Follow the steps to complete the Omb No 1545 1621 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. Ensure that your name, address, and identification numbers are accurate and match the documents you are submitting.

- Carefully complete any financial details requested in the form. Double-check your entries to ensure they reflect your current financial status.

- Fill in additional sections as prompted. Some forms may require specific declarations or additional documentation—be thorough in this part to avoid delays.

- Review all information entered in the form. Validate that every detail is correct and complete to prevent any issues later in the process.

- Once satisfied with your entries, save your changes. You will have the option to download, print, or share the completed form as needed.

Complete your Omb No 1545 1621 form online today and streamline your document management process.

The W-8BEN serves to certify your foreign status and claim any applicable tax treaty benefits. This is particularly important for preventing excessive tax withholding on income sourced in the US. It establishes your eligibility for tax reliefs, safeguarding your financial interests within the framework of Omb No 1545 1621.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.