Get Sba Form 172

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 172 online

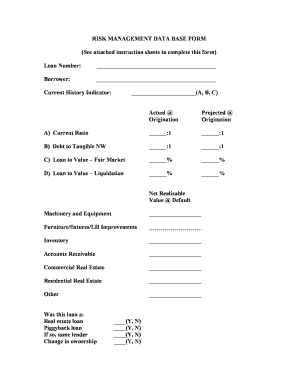

Filling out the Sba Form 172 is an important step for borrowers seeking to ensure compliance with SBA reporting requirements. This guide provides a clear and concise walkthrough of each section of the form to facilitate your online completion.

Follow the steps to accurately complete the Sba Form 172.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the loan number in the designated field, ensuring it is accurate to facilitate proper record keeping.

- In the borrower section, clearly provide the name of the individual or entity that is the borrower.

- Select the current history indicator by designating A, B, or C. Refer to the definitions provided to select the appropriate rating based on the borrower's credit history.

- Fill in the actual and projected ratios for the current ratio, debt to tangible net worth, loan to value – fair market, and loan to value – liquidation as required, ensuring that all calculations reflect accurate financial data.

- Complete the net realizable value section by listing values for machinery and equipment, furniture/fixtures/LH improvements, inventory, accounts receivable, commercial real estate, residential real estate, and any other relevant assets.

- Indicate whether this loan is a real estate loan, piggyback loan, or a change in ownership by selecting yes or no for each category.

- Review the completed form for accuracy and ensure all required fields have been filled out correctly.

- Once you have ensured the form is complete, save your changes, and use the options to download, print, or share the document as necessary.

Complete your Sba Form 172 online today to ensure your loan application process is smooth and compliant.

The 20% rule for SBA indicates that the business owner must inject at least 20% of their own capital into the project. This requirement is crucial in the SBA lending process, as it demonstrates your commitment and reduces the lender's risk. By filling out the Sba Form 172, you can provide essential financial information that supports your application. Understanding this rule can help you prepare a stronger application for SBA financing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.