Loading

Get Trust Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Questionnaire online

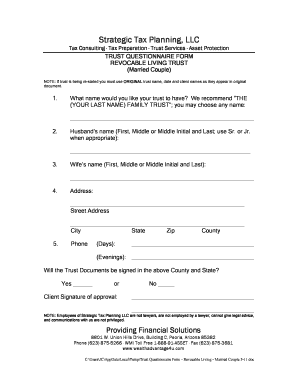

Filling out the Trust Questionnaire is a crucial step in establishing your revocable living trust. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Trust Questionnaire with ease.

- Press the ‘Get Form’ button to obtain the questionnaire and open it in the designated editor.

- Enter the name you would like for your trust. A common suggestion is 'THE (YOUR LAST NAME) FAMILY TRUST,' but you may select any name you prefer.

- Provide the husband's full name, including first name, middle name or initial, and last name. Use 'Sr.' or 'Jr.' if applicable.

- Enter the wife's full name following the same format as the husband's name.

- Fill in the street address, city, state, zip code, and county where you reside.

- Fill out the daytime and evening phone numbers for both parties.

- Indicate whether the trust documents will be signed in the county and state provided. Mark 'Yes' or 'No' and ensure you sign your approval.

- Choose the level of control you want the surviving spouse to have over the trust by selecting one of the three options provided, ensuring to elaborate where necessary.

- List the individuals who should inherit assets after both spouses have passed away, including detailing their relationships and percentages of inheritance.

- Identify any alternate individuals who should inherit if those listed in step 9 are no longer alive.

- Specify if any family members are intentionally excluded from inheriting assets.

- Choose one of the four postponement options if applicable, detailing the age at which control over inheritances will be granted.

- List the preferred successor trustee in order of priority, with the option to include co-trustees.

- Designate individuals who should ideally direct investments, distinct from the successor trustee.

- Choose individuals for health care decisions if both spouses are not mentally competent.

- Identify guardians for any minor children and list them in order of preference.

- Indicate preferences regarding living wills, cremation, organ donation, and mental health care power of attorney for both spouses.

- Complete the final questions about notifications to heirs and dispute resolution.

- Review your completed form for accuracy. Once satisfied, you can save changes, download, print, or share the Trust Questionnaire.

Complete your Trust Questionnaire online today to ensure your wishes are honored.

To show trust income, you must complete IRS Form 1041 and any applicable schedules detailing the income generated by trust assets. This form must include all sources of income, whether from interest, dividends, or capital gains. You can simplify gathering this information with a Trust Questionnaire that organizes your trust's income details. Properly documenting trust income helps ensure transparency in reporting and compliance with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.