Loading

Get Repo Order Form 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Repo Order Form online

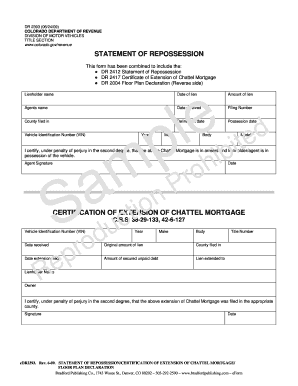

Filling out the Repo Order Form online can be straightforward when you follow a structured approach. This guide provides detailed steps to help you understand each component of the form and assist you in completing it accurately.

Follow the steps to successfully complete the Repo Order Form.

- Click ‘Get Form’ button to obtain the Repo Order Form and open it in your browser.

- In the first section, enter the lienholder name, which is the person or organization holding the claim or interest in the vehicle.

- Next, input the date of the lien, indicating when the lien was established.

- Provide the agent's name responsible for overseeing the repossession process.

- Specify the county where the lien is filed as part of the detail required for internal records.

- Fill in the Vehicle Identification Number (VIN), a unique identifier for the vehicle in question.

- Indicate the year of the vehicle, essential for properly identifying it.

- Enter the amount of the lien, which is the total amount owed on the lien at the time of repossession.

- Continue to the possession details. Record the date received, filing number, delinquent date, and possession date to document the timeline of events.

- Provide the make and model of the vehicle to ensure accurate identification.

- At the conclusion of the form, certify that the information provided is accurate by signing and dating the certification section, ensuring your compliance with legal requirements.

- Once all fields are filled, you can save your changes, download, print, or share the completed form as necessary.

Now that you have the steps, fill out the Repo Order Form online to ensure a smooth process.

A bank can locate your car for repossession through various means, including GPS tracking installed in the vehicle or through public records. They often rely on the same tools that help facilitate Repo Order Form processes, enabling them to efficiently track assets tied to unpaid loans. It's important to engage openly with lenders to avoid misunderstandings about your obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.