Loading

Get Fillable Depreciation Worksheet 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Depreciation Worksheet online

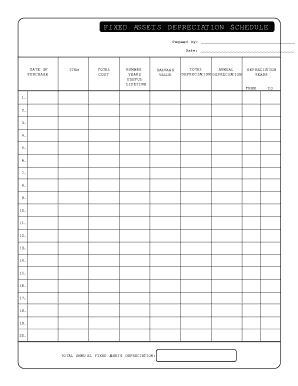

This guide provides comprehensive instructions on how to effectively complete the Fillable Depreciation Worksheet online. Understanding how to fill out this form can simplify the process of tracking your fixed asset depreciation.

Follow the steps to successfully complete your Fillable Depreciation Worksheet.

- Click the ‘Get Form’ button to access the Fillable Depreciation Worksheet and open it in your preferred online editor.

- Input the individual or organization preparing the form in the 'Prepared by' section. This information ensures proper attribution and tracking.

- In the 'Date of Purchase' column, provide the date when each asset was acquired. Accurate dates are crucial for calculating depreciation.

- Record the 'Total Cost' of each asset in the respective column. This should include the purchase price and any additional costs required to make the asset ready for use.

- Indicate the 'Salvage Value' for each asset, which is the estimated value at the end of its useful life. This figure is essential for calculating total annual depreciation.

- Continue filling out the depreciation schedule for each asset up to 20 entries in the designated fields provided.

- Once all entries are complete, review your worksheet for accuracy. You can then save your changes, download the document, print it, or share it as needed.

Complete your Fillable Depreciation Worksheet online today to streamline your asset tracking process.

The primary IRS form used to report depreciation is Form 4562. This form allows you to enter depreciation deductions for your assets, ensuring you meet tax obligations. Utilizing a Fillable Depreciation Worksheet can help you collect the required information effectively, making the filing process easier and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.