Loading

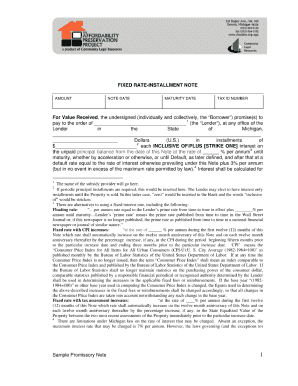

Get Sample Promissory Installment Note Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Promissory Installment Note Form online

Filling out the Sample Promissory Installment Note Form online can be a straightforward process. This guide will provide you with clear, step-by-step instructions to help you complete this important document accurately and efficiently.

Follow the steps to fill out the form correctly.

- Use the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the date at the top of the form, ensuring it reflects the date you are completing the document.

- Fill in the borrower's name and address in the designated fields. This is important for identifying who is liable for the note.

- Enter the lender's name and address in the corresponding fields, clearly identifying who is providing the funds.

- Specify the principal amount being borrowed in the appropriate section, making sure to double-check the figures for accuracy.

- Detail the interest rate and repayment terms in the respective sections, including payment frequency and the total number of payments.

- Include information about any late fees or penalties that may apply in case of missed payments.

- If applicable, provide any collateral details in the designated field, outlining what, if anything, the loan is secured against.

- Finally, review the entire form for accuracy before signing. Ensure all necessary fields are completed, then save or print the document if needed.

Complete your documents online with ease and confidence.

Yes, you can draft your own promissory note, as long as it complies with legal requirements. Using a Sample Promissory Installment Note Form can simplify this process. You can include specific terms that suit your situation while ensuring that all necessary elements are present. However, it's wise to consult legal advice if you have any doubts about your draft.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.