Get Mortgage Subordination Agreement Wisconsin Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Subordination Agreement Wisconsin Form online

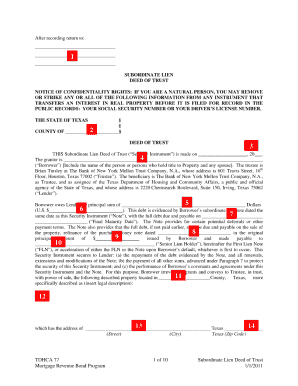

The Mortgage Subordination Agreement Wisconsin Form is a vital document used in refinancing situations where existing mortgage terms need to be adjusted. This guide will help you navigate the online filling process seamlessly and effectively, ensuring that all necessary information is completed correctly.

Follow the steps to fill out the Mortgage Subordination Agreement Wisconsin Form online

- Press the ‘Get Form’ button to access the online version of the Mortgage Subordination Agreement Wisconsin Form. This will open the document in a digital editor, allowing you to begin the completion process.

- Carefully review the introductory section of the form. This portion usually includes important instructions and explanations regarding the purpose of the agreement. Understanding these details is essential before proceeding.

- In the designated fields, enter the names and addresses of the parties involved. Ensure that all names are spelled correctly and that the information is current to avoid issues later on.

- Fill in the details regarding the current mortgage, including the lender's name, the property address, and any relevant account numbers. Double-check these entries for accuracy.

- Next, provide the new loan information, which typically includes the new lender's information, the loan amount, and any other specifics required by the form.

- If applicable, include any additional clauses or provisions as necessary. Review any predefined sections carefully to ensure compliance with all requirements.

- Once all fields are filled out, review the entire document for completeness and accuracy. It is crucial that every section is correctly completed before moving forward.

- After confirming that all information is accurate, you can choose to save your changes, download the completed form, and either print it or share it as required. Make sure to keep a copy for your records.

Start filling out your documents online today for a smoother experience.

A lender may agree to a subordination agreement to encourage a borrower to refinance or secure a better interest rate. By subordinating their lien, the lender might attract more business from borrowers seeking favorable terms. Ultimately, a Mortgage Subordination Agreement Wisconsin Form facilitates these arrangements and strengthens goodwill between lenders and borrowers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.