Loading

Get 1099 Form Contractors 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Form Contractors online

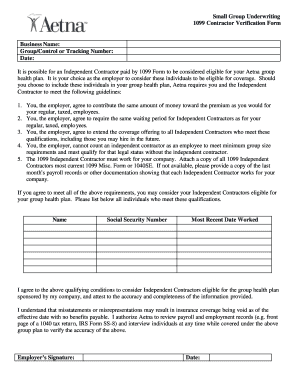

Filling out the 1099 Form Contractors can be straightforward with the right guidance. This form is essential for reporting payments made to independent contractors, ensuring compliance with tax regulations.

Follow the steps to efficiently complete your 1099 Form Contractors online.

- Press the ‘Get Form’ button to acquire the form and open it within your preferred document editor.

- Enter your business name in the designated field at the top of the form. Ensure the name matches your legal business name for accurate reporting.

- Input the Group/Control or Tracking Number if applicable. This number helps identify your account or group with the payer.

- Fill in the date on which you are completing the form. This date is crucial for record-keeping and verification purposes.

- List all independent contractors who are eligible based on the provided guidelines. Fill in their name, Social Security Number, and most recent date worked in the appropriate sections.

- Include a statement of agreement regarding the conditions for considering the independent contractors eligible for the group health plan. Ensure this statement is clearly signed and dated by the employer.

- Attach any necessary documentation as instructed, including the latest 1099 Misc. Form or 1040SE for each contractor listed.

- Review the completed form for accuracy and completeness, ensuring that all entries conform to the requirements.

- Once satisfied with the entries, save your changes. You can download, print, or share the completed form as required.

Take the next step in efficient document management by completing your 1099 Form Contractors online today.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the “employer” or the individual in question furnishes the equipment used ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.