Get Employee Stock Purchase Plan Enrollment Form 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Stock Purchase Plan Enrollment Form online

Filling out the Employee Stock Purchase Plan Enrollment Form online can streamline the process of participating in the plan, providing you with ownership opportunities within your company. This guide will lead you through each step to ensure that your form is completed accurately and efficiently.

Follow the steps to complete your enrollment form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

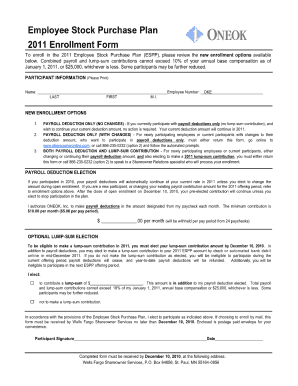

- Begin by filling in your personal information, which typically includes your full name, employee ID, and contact details. Ensure that all entries are accurate to avoid any processing delays.

- Next, review the eligibility criteria outlined within the document. Confirm that you meet all necessary requirements to participate in the Employee Stock Purchase Plan.

- Indicate the percentage of your eligible compensation that you would like to contribute towards purchasing stock. Double-check this percentage as it impacts your investment.

- Provide your banking information for the direct deposit of your contributions if applicable. Make sure this information is entered correctly to facilitate smooth transactions.

- Read through the terms and conditions associated with the plan carefully. Make any necessary notes or clarifications where required, and ensure you understand your rights and obligations.

- Finally, review all filled sections for completeness and accuracy. Once satisfied, you can save changes, download, print, or share the form.

Complete your Employee Stock Purchase Plan Enrollment Form online today!

Creating an employee stock option plan involves several key steps, starting with identifying your workforce needs and business goals. You will need to craft a detailed plan document outlining eligibility, allocation, and exercise terms. Utilize the Employee Stock Purchase Plan Enrollment Form to provide employees with a straightforward way to access and understand their options, making your plan transparent and efficient.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.