Loading

Get Rev 2008 Form 433 A 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev 2008 Form 433 A online

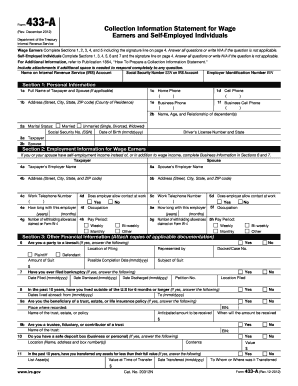

Filling out the Rev 2008 Form 433 A is an important step in providing the Internal Revenue Service with a detailed picture of your financial situation. This guide will walk you through each section of the form, ensuring you have all the necessary information to complete it accurately.

Follow the steps to successfully complete the Rev 2008 Form 433 A online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Complete Section 1: Personal Information. Include your full name, address, contact numbers, and details regarding your marital status and dependents. Be sure to answer all required questions or indicate N/A when a question does not apply.

- Move to Section 2: Employment Information for Wage Earners. If you or your spouse are employed, provide the employer's name, contact information, duration of employment, occupation, and details of withholding allowances claimed on Form W-4.

- In Section 3: Other Financial Information, disclose any lawsuits, bankruptcy filings, and trusts. Follow the prompts for attaching any necessary documentation if applicable.

- Proceed to Section 4: Personal Asset Information. You will need to list your cash on hand, bank accounts, investments, credit availability, and other assets. Include current values and any associated loans.

- Complete Section 5: Monthly Income and Expenses, detailing your total income sources and monthly living expenses. Calculate the net difference to assess financial viability.

- If self-employed, continue to Sections 6 and 7. Provide detailed business information, including total revenues and expenses, and ensure the figures reconcile with your profit and loss statements.

- Finally, review all sections for accuracy, ensuring you have signed and dated the certification statement at the end of the form. Save your changes, and then you can download, print, or share the completed form.

Start completing your Rev 2008 Form 433 A online now!

Once again, the Rev 2008 Form 433 A focuses on individual taxpayers, while Form 433 B targets businesses. Each form collects necessary financial data tailored to different circumstances. Therefore, selecting the correct form is vital for effective communication with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.