Loading

Get Va4 Form 2012 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va4 Form 2012 online

Filling out the Va4 Form 2012 online can streamline the process and ensure your information is recorded accurately. This guide provides you with step-by-step instructions to navigate through the form effectively.

Follow the steps to complete the Va4 Form 2012 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with the personal information section, where you will provide your name, contact details, and any relevant identification numbers. Ensure that all entries are accurate and match your official documents.

- Proceed to the employment information section. Here, include details about your current employment status, job title, and employer's information. Make sure to double-check for completeness.

- Next, you will address any additional eligibility criteria outlined in the form. Carefully read each question and respond accordingly, ensuring that your answers reflect your current situation.

- Review the declarations section. This part may require you to confirm that the information you provided is truthful. Be cautious and understand the implications of your declaration.

- Finally, save your changes, and you can choose to download, print, or share the completed form as needed. Make sure to keep a copy for your records.

Start completing your documents online today for a smoother process.

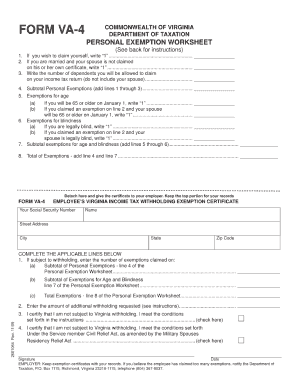

A form VA-4 is the official document used in Virginia for employees to declare their tax withholding preferences. It helps employers calculate the correct amount of state taxes to withhold from employees' paychecks. By accurately filling out the VA-4, employees can manage their tax obligations more effectively. The VA4 Form 2012 contains updates relevant to the tax year, ensuring compliance with state laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.