Loading

Get Payroll Receipt 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Receipt online

Filling out the Payroll Receipt is a straightforward process that ensures you acknowledge your payroll details accurately. This guide provides step-by-step instructions to help you complete the form with ease.

Follow the steps to accurately fill out your Payroll Receipt

- Click ‘Get Form’ button to obtain the form and open it in the editor.

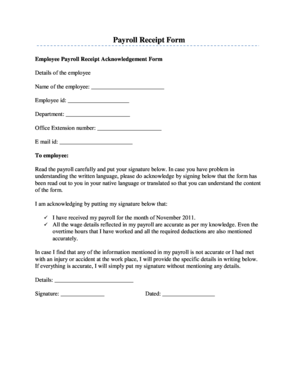

- Begin by filling in your personal details. This includes entering your name in the designated field, followed by your employee ID, department, office extension number, and email ID.

- Read the payroll details carefully. It is important to ensure you understand the information presented. If you require assistance in understanding the language, acknowledge that the form has been translated or read to you in your native language.

- You must sign below as acknowledgment that you have read and understood the payroll details.

- Confirm that you have received your payroll for the specified month. Verify that the wage details, including any overtime hours and deductions, are accurate to the best of your knowledge.

- If you find any discrepancies in the information, provide specific details in the available space. If everything is correct, simply put your signature in the designated area without adding any additional information.

- Finally, enter the date when you are signing the form. Review all the information filled in before proceeding.

- Upon completing the form, you can save the changes, download a copy, print it for your records, or share it as necessary.

Complete your Payroll Receipt online today to ensure accurate acknowledgment of your payroll details.

To file receipts and invoices, organize them by category, such as payroll receipts, expenses, and other business transactions. Use a physical filing system or digital storage, ensuring each document is labeled with relevant information like the date and purpose. Regularly review and update your files to maintain accuracy and compliance. Utilizing platforms like USLegalForms can streamline this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.