Loading

Get Tangible Net Benefit Form Illinois 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tangible Net Benefit Form Illinois online

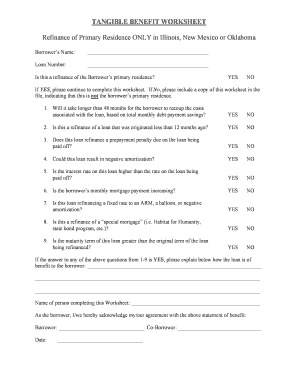

The Tangible Net Benefit Form Illinois is a crucial document for borrowers seeking to refinance their primary residence in Illinois. This guide provides clear, step-by-step instructions to help users complete the form easily and accurately online.

Follow the steps to effectively complete the Tangible Net Benefit Form.

- Press the ‘Get Form’ button to access the Tangible Net Benefit Form and open it for editing.

- Begin by entering the borrower's name in the designated field. Ensure that the name is spelled correctly to avoid processing delays.

- Next, input the loan number in the corresponding field. This information is essential for identifying the specific loan involved in the refinancing process.

- Respond to the question about whether this refinancing pertains to the borrower's primary residence by selecting 'YES' or 'NO.' If 'NO,' make a note on the form and proceed as instructed.

- For each of the nine subsequent questions, carefully consider your answers. Indicate 'YES' or 'NO' for each question, reflecting your situation accurately.

- If you answer 'YES' to any of the questions, provide a detailed explanation of how the loan will benefit the borrower in the space provided below those questions.

- Complete the final section by entering the name of the person filling out the form. Ensure this aligns with the borrower’s information.

- The borrower and, if applicable, the co-borrower should acknowledge their agreement with the statements by signing and dating the form.

- Once you have filled out all fields, review the document for accuracy. You can then save your changes, download the completed form, print it out, or share it as needed.

Complete your Tangible Net Benefit Form online today to facilitate your refinancing process.

Yes, Fannie Mae requires that a tangible net benefit be demonstrated for certain refinancing opportunities. This requirement ensures that borrowers gain meaningful financial advantages from their loans. By filling out the Tangible Net Benefit Form Illinois, borrowers can confidently present their case and meet Fannie Mae's standards for refinancing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.