Loading

Get Subrogation Claim

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subrogation Claim online

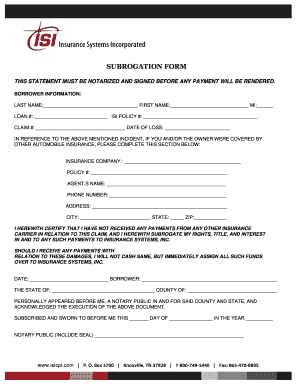

Filling out the Subrogation Claim form online can streamline the process of submitting your claim. This guide offers clear and concise instructions to help you navigate each section effectively.

Follow the steps to complete the Subrogation Claim form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your last name, first name, and middle initial in the respective fields. Make sure to spell everything correctly as this information is critical for identification.

- Input your loan number in the corresponding field. This helps to associate your claim with your loan account.

- Provide your insurance policy number. This number is essential for identifying which policy the claim relates to.

- Fill in the claim number and the date of loss in the designated fields. These details are vital for processing your subrogation claim.

- If you or the owner had other automobile insurance regarding the incident, complete the insurance company section with the name, policy number, agent's name, phone number, address, city, state, and ZIP code.

- Certify that you have not received any payments from any other insurance carrier related to this claim by signing in the borrower signature space provided.

- Date the document where indicated to confirm when you filled out the claim.

- In the notary public section, be prepared to have the document notarized, which means a notary public will need to witness your signature.

- After carefully reviewing the filled form for any errors, you can save changes, download, print, or share the form electronically.

Complete your Subrogation Claim online today for swift processing!

The duration of subrogation can vary widely depending on the complexity of the case. Generally, the process can take anywhere from a few months to several years, particularly if legal disputes arise. Factors such as the cooperation of involved parties and the volume of evidence can influence timelines as well. By choosing a reliable platform like US Legal Forms, you can streamline your subrogation claim process and better understand what to expect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.