Loading

Get Td1bc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Td1bc online

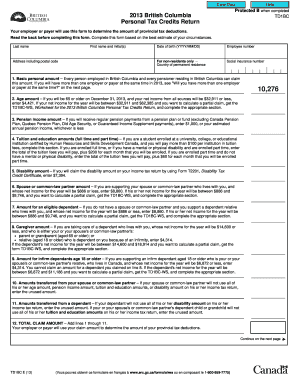

The Td1bc form is essential for individuals working in British Columbia or pensioners residing there, as it determines provincial tax deductions. Completing this form accurately is crucial for your tax situation, and this guide will walk you through each section step-by-step.

Follow the steps to complete the Td1bc form online

- Click the ‘Get Form’ button to access the Td1bc form and open it in your preferred platform for editing.

- Enter your last name in the designated field.

- Provide your first name and any initials that are applicable.

- Fill in your complete address, ensuring to include your postal code.

- Input your date of birth using the format YYYY/MM/DD.

- If applicable, write down your employee number.

- For non-residents, indicate your country of permanent residence.

- Enter your social insurance number in the required section.

- In the section for the basic personal amount, claim the amount of $10,276.

- If you will be 65 or older by December 31, 2013, and your net income will be $32,911 or less, enter the age amount of $4,421. If your income is between $32,911 and $62,385, refer to the TD1BC-WS for more information.

- If receiving regular pension payments, enter the pension income amount as applicable.

- Complete the tuition and education amounts section based on your enrollment status and fees.

- If claiming the disability amount, enter the value of $7,394.

- If supporting a spouse or common-law partner, fill in the corresponding amounts based on their net income.

- For dependants, complete the relevant sections based on your relationships and their net incomes.

- Calculate the total claim amount by adding lines 1 through 11.

- Review all information for accuracy, sign and date the form before submission.

- Submit the completed form to your employer or payer. You can save changes, download a copy, print it, or share it as necessary.

Complete your Td1bc form online to ensure accurate tax deductions.

To claim the BC tax credit, ensure that you complete the necessary TD1 forms accurately and submit them with your annual tax return. Keeping accurate records of your income and allowable deductions will facilitate the claiming process. The Td1bc form is a vital tool in maximizing your tax credits and ensuring you receive the benefits you qualify for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.