Loading

Get 2008 Md 505 Form Fillable 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Md 505 Form Fillable online

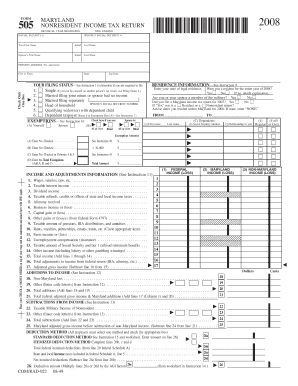

Filling out the 2008 Md 505 Form Fillable online can streamline your tax filing process. This guide provides a detailed walkthrough of each section of the form, ensuring clarity and ease for all users, regardless of their tax experience.

Follow the steps to complete your Maryland nonresident income tax return online.

- Press the ‘Get Form’ button to download the 2008 Md 505 Form Fillable and open it in your preferred online editor.

- Begin by entering your first name, middle initial, and last name in the designated fields at the top of the form. Make sure all names are spelled correctly.

- Fill out the social security number fields for both you and your spouse, if applicable. Ensure these numbers are accurate to avoid processing delays.

- Provide your present address, including street number, city, state, and zip code. Double-check this information for accuracy.

- Select your filing status by checking the appropriate box. Refer to Instruction 1 if you are unsure about your filing status.

- Indicate whether you or your spouse is a member of the military by checking the corresponding box.

- Under exemptions, mark the box indicating if you or your spouse is 65 or older or blind, if applicable. Enter the number of dependents in the designated area.

- Provide your income details in the relevant sections, ensuring you categorize them correctly as federal, Maryland, or non-Maryland income.

- Choose between the standard deduction method or the itemized deduction method and fill in the appropriate lines based on your choice.

- Complete the Maryland tax computation sections and calculate your total taxes owed, following the form’s instructions closely.

- Finish by signing and dating the form at the bottom. If applicable, have your spouse sign as well.

- Once you have completed the form, save your changes, download or print the document, and ensure it is securely sent to the relevant tax authority.

Complete your tax documents online today for a seamless filing experience.

You should file MD Form 510 with the Maryland Comptroller's office if you are required to submit this income tax form. Review the filing instructions to ensure you meet any deadlines and provide accurate information. For a smoother filing experience, you may consider incorporating the 2008 Md 505 Form Fillable to gather all necessary data. US Legal Forms can facilitate your filing process, helping you stay organized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.