Loading

Get Dependent Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dependent Form online

Filling out the Dependent Form online can streamline your submission process for dependent care expenses. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your Dependent Form.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

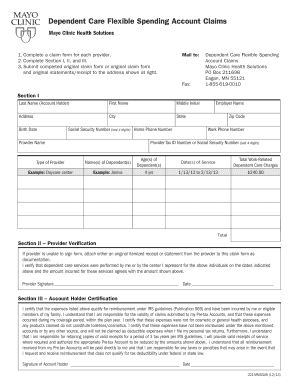

- Complete Section I by filling in your last name, first name, middle initial, and address. Include your city, state, zip code, and home phone number. Then, add your birth date and the last four digits of your Social Security number. Next, input your provider's name and employer's name, along with the work phone number.

- In Section I, you will also need to provide the provider tax ID number or the last four digits of their Social Security number. Specify the type of provider and list the names and ages of your dependents.

- Include the date(s) of service for which you are claiming expenses. Fill in the total work-related dependent care charges incurred during the specified timeframe.

- Move to Section II for provider verification. If your provider is unavailable to sign the form, attach an original itemized receipt or a statement as documentation. Ensure you have the provider's signature and date on this section.

- Proceed to Section III for account holder certification. Here, sign to certify that the expenses are legitimate and qualify for reimbursement according to IRS guidelines. Date your signature.

- Once all sections are completed, save the changes. You can then download, print, or share the form for submission as required.

Complete your documents online today for a smoother submission process.

Claiming yourself as a dependent requires filling out the appropriate forms like the Dependent Form, detailing your relationship to the person claiming you. Make sure to provide clear information about your living situation and financial support. Accurate submissions can significantly reduce your tax burden, so it is critical to understand the rules. Resources offered by uslegalforms can assist you in navigating these requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.