Loading

Get Odot Form 735 9002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Odot Form 735 9002 online

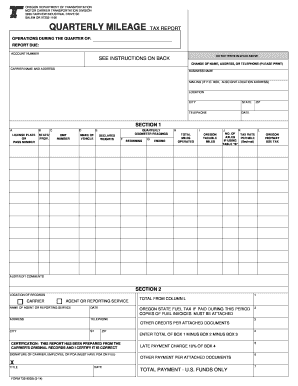

Filling out the Odot Form 735 9002 online is a straightforward process designed to help users report their quarterly mileage accurately. This guide will provide comprehensive, step-by-step instructions to ensure that all necessary information is completed correctly.

Follow the steps to fill out the Odot Form 735 9002 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your account number at the top of the form.

- In the ‘Carrier name and address’ section, fill in the business name, mailing address (including P.O. Box if applicable), city, state, telephone number, and ZIP code.

- Proceed to Section 1. Start with Column A, entering the plate or pass number of the power unit you are reporting.

- In Column B, input the state or province that issued the license plate.

- For Column C, enter the company's unit number related to the power unit.

- In Column D, please provide the make of the vehicle.

- Column E requires you to declare the weights for operations. Enter the heaviest weight operated per configuration.

- Enter the beginning odometer reading for the reporting period in Column F.

- In Column G, enter the ending odometer reading for the last day of the quarter.

- Calculate the total miles operated for each vehicle and enter that in Column H (Column G minus Column F).

- Fill Column I with the Oregon taxable miles operated on public roads.

- Enter the number of axles for any declared weight above 80,000 pounds in Column J.

- In Column K, enter the appropriate tax rate from the mileage tax rates provided.

- Column L requires you to compute and enter the Oregon Highway Use Tax (Column I times Column K).

- For Section 2, manage your payment details: Enter totals in Box 1, Box 2 (Oregon state fuel tax), Box 3 (other credits), and compute Box 4.

- If applicable, include a 10% late payment in Box 5.

- Add any other payments in Box 6 and compute the final total in Box 7.

- Ensure the certification section is signed by an authorized representative or agent. Attach any necessary documentation.

- Finally, save your changes, download, and print the form or share it as needed.

Complete your documents online with confidence and ensure accurate reporting.

To report mileage on an Over-Dimensional Permit, contact OD Permits at 503-373-0000. DUE DATE: Your report and payment must be postmarked by the Postal Service by the last day of the month following the end of the calendar month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.