Loading

Get Form Si 2002 2848

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Si 2002 2848 online

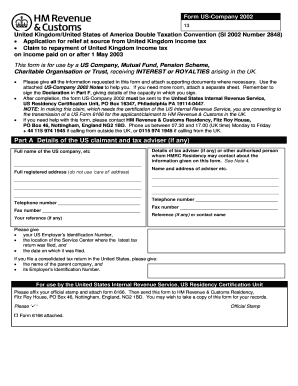

Completing Form Si 2002 2848 is an essential task for US companies, mutual funds, and other organizations seeking relief from United Kingdom income tax. This guide provides clear, step-by-step instructions for filling out the form effectively and submitting it online.

Follow the steps to successfully complete Form Si 2002 2848 online.

- To begin, click the ‘Get Form’ button to access the Form Si 2002 2848 and open it in your preferred editing tool.

- In Part A, provide details of the US claimant and any tax adviser. This includes the full name, registered address (do not use a ‘care of’ address), telephone and fax numbers, and US Employer Identification Number.

- Complete the details of the tax adviser if applicable, providing their name and contact information.

- Ensure you fill in the location of the Service Center where your latest tax return was filed along with its filing date.

- Move to Part B and answer all questions thoroughly. This includes determining if the claim is the first of its kind, the status of the claimant, and if the income is under any conduit arrangement.

- Continue through Part B, answering specific questions based on whether the claimant is a US company, mutual fund, pension scheme, charitable organization, or trust.

- In Part C, select the appropriate section to apply for relief at source from UK income tax, and provide the required information about interest or royalties.

- If applicable, complete Part D for claiming repayment if the company has received payments with UK income tax deducted.

- Fill out Part E if you wish to authorize a nominee to receive repayment on behalf of the company.

- Finally, in Part F, sign the declaration confirming the accuracy of the information provided and submit the form as directed.

Take the necessary steps and complete your Form Si 2002 2848 online today!

The DT-individual is a term used to describe tax identification for individuals in Germany. It helps in managing and tracking personal tax liabilities effectively. Understanding the differences in tax systems is crucial, especially if you're also dealing with forms like Form Si 2002 2848. Platforms like USLegalForms provide guidance for navigating such nuances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.